How to live without debt

This is the first day in our plan to dig out of debt and get to live the life you want. Retire? I am sure you are thinking how I can do that? I have credit cards that are currently paying off credit cards. I owe for my house, car, medical bills, in fact, I am sure you even owe your kid money.

It is fine we were there. We were in debt. We had three houses and three kids and we had more money going out then coming in until we made big changes.

The point is how did we go from owing people money to owing no one. The answer is simple. The process isn’t, but it can be done. We did it and so can you.

I hope you will join me as I spend the next 30 days sharing the motivation and information you will need to get on track. I plan to attack this issue like I attack the dishes each night with gusto, resolve, and all the tools necessary to clean up the mess.

The first thing you will need is your toolkit:

notebook

pen

calculator

computer/ phone

bank statements

credit card statements

bills (everything you pay all year long. You should be able to open your checkbook or bank statement for help with this)

Next, you will fill in the out the budget tools you find in the post-

How to Save Money by Using a Calendar

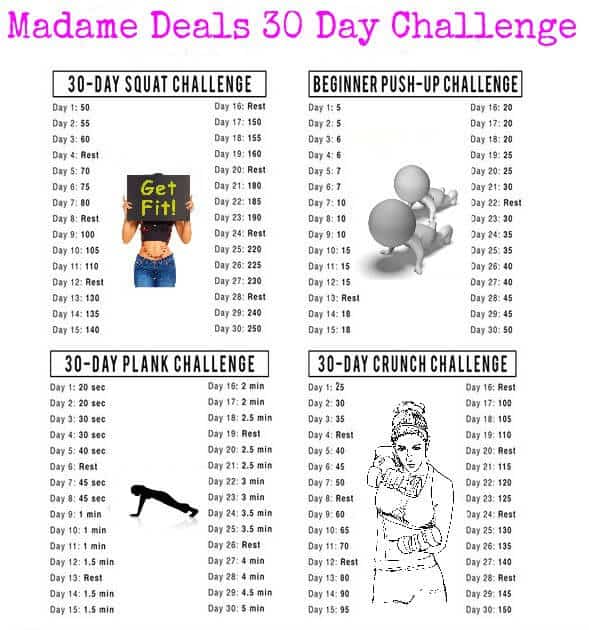

I know that is a lot for day one. Since I am doing the fitness and finance slim down. This is your homework for your fitness challenge do 30 minutes of light exercise. You can go on a walk. You can walk up and down your stairs. You can do push ups, sit ups, squats. You can even pick up 1/g gallon jugs filled with water. You need to move for 30 minutes. If you want this is the challenge I intend to start my 30- day to a better body.

Cook, Baker, Phototaker, Fitness Mover and Shaker, Cupcake Tester, Deal Maker, Adventurous Undertaker, Do Good “Deeder”, Teacher, Mom, Wife, Patriot for Life & Giver of Good Advice – RealAdviceGal