Military Costs You Need to Know About

Disclosure: This is a sponsored post on behalf of Credit Karma® and The Motherhood, all opinions expressed here are mine.

Military Costs You Need to Know About

When you sign up to serve and protect your country, you fail to realize that there will be cases when being in the military is far more expensive than being a civilian. The financial implications of your spending decisions will be felt at each station where you’re deployed. There are a lot of military deployment costs associated with a military service career. I decided to outline a couple that occurred while my husband was serving our country because I think it is important to plan for these costs by setting aside money for these known expenses.

Military Deployment Costs:

Deposits for housing, utilities, and water

Costs associated with turning on phone, the Internet, cable

Deposits lost on your last rental property

Fees to clean up the last property

Pet fees that were not deposits

Loss of food since you usually do not move it when you leave

Stocking your kitchen again with everything all at once

Food costs because when you do not have a kitchen or your kitchen equipment you have to eat out which is pricey

Temporary housing while you find permanent housing or while waiting for housing to open up

Hotels while you drive or travel to your next duty station

Costs associated with moving pets (Vet visits, airplane tickets, carriers etc.) We had to put our dog in a kennel in Hawaii, by the time I was done it cost me $1,000.

Furniture rental while awaiting your goods

Repair or replacement of property that is lost, damaged or stolen. You never get what the new item cost you get a depreciated value.

Airplane tickets depending on your new station

Repairs and increased mileage on vehicles if you drive

Additional transport charges if you ship another vehicle since certain places only one car is covered

Buying another car at your new duty station. You usually lose money on cars.

New clothing purchases if you are deployed from a hot location to a cold one

Physical exams for your children entering a new school

Cost associated with starting a new school, supplies, dues, clothes

Job placement services for your spouse as they relocate they lose their job

New uniforms or uniforms that are weather appropriate When we moved to Hawaii my husband bought new uniforms as opposed to the ones he wore in Rhode Island.

Lost income while your spouse searches for another job

Costs associated with a preparing your new property for your family

Can you think of additional cost associated with being in the service? I am sure I missed something.

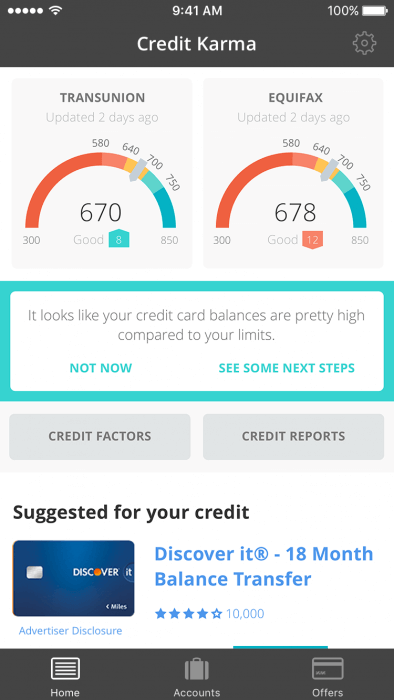

Expenses associated with deployment, frequent relocations, and insufficient wages are just some of the unique financial challenges and hardships that military families face. These challenges can be overwhelming and can lead to financial decisions that negatively affect your credit scores. This is a double edge sword as many military roles require the enlisted member maintain a good credit score. Credit Karma® can help.

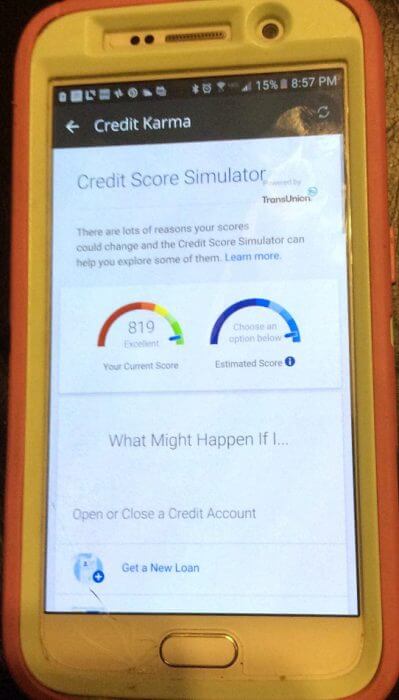

The Credit Karma® mobile app and website has valuable tools to help military families be better prepared to deal with all their unique financial challenges including military deployment costs. The Credit Score Simulator will enable military families to see what kind of impact hypothetical financial scenarios will have on their credit score. Knowing the impact your decisions make on your credit score is key to making sure you do what is best for your financial well being.

Image credit: Credit Karma (information shown is not my personal information)

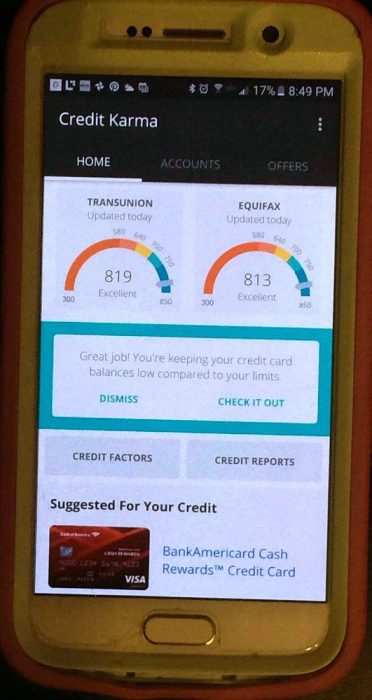

Credit Karma also provides access to credit reports from two major bureaus that update each week which allows military families greater insight into their financial picture. Credit Karma’s credit monitoring will allow military families to be notified about changes to their credit reports which is a very valuable tool for catching fraud early. You can also use Direct Dispute™ to easily notify a credit bureau of errors or mistakes on their credit reports. With just a few clicks, these can submitted for removal. Believe it or not, as many as 1 out of 4 credit reports contain errors! For example, I have never lived in California and my credit report listed a residence for me in CA that was the address of one of my relatives.

Image credit: Credit Karma (information shown is not my personal information)

Please feel free to share your ideas for preparing for military deployment costs or any associated costs that I may have missed. Enter our giveaway below and don’t forget to download the mobile app and get the Credit Score Simulator so you can be prepared for deployment costs.

$50 VISA Gift Card Giveaway

Please wait for the rafflecopter to load above.

Giveaway is open to U.S. only and ends on 5/31/16.

Cook, Baker, Phototaker, Fitness Mover and Shaker, Cupcake Tester, Deal Maker, Adventurous Undertaker, Do Good “Deeder”, Teacher, Mom, Wife, Patriot for Life & Giver of Good Advice – RealAdviceGal