Being Cheap Almost Kills Me

I hate being cheap. I promise you will not “die”. It may feel like it when your kids ask for something they really want that you could buy and you say no. It may feel like it when you want that juicy steak and instead order a hamburger. It may feel like it when your friends are going on fancy vacations and you are doing a stay vacation using hotel points and you brought your instant pot to be able to cook one meal a day in your room.

I dislike being frugal. It takes a lot of explanation to tell your kids. “no”. It often sucks to not have a new car. We spend a lot on car repairs each year but truthfully we pay a lot less than a new car would cost each year. I just never knew sacrifice could be so difficult. It is hard to tell our kids that isn’t in the budget when frankly, we have the money. It is hard to say we can’t go out to dinner this week because we spent a lot on groceries and that took up the majority of our weekly food budget.

I remember in times of hardship how good it feels to ask for the cash discount and know I actually have the cash to get a discount. I like knowing that if our washer breaks after we evaluate the cost to purchase a new one, verse repair cost, verse time already in use we could buy a new machine without giving up something else. I like being free!

This is how to live debt free you have to be all in. You can’t cheat. Think of this as your diet of a lifetime. If you are a cheater that is fine. I am a cheater. I build my cheating into our budget. I evaluate what we buy daily. Then when I make my yearly budget. I put in what I need to be happy. You will see what I spent last week and see I spent $54 for the gym and money on clothes. I like to shop so I actually have $100 a week in what I call fun money then I have another $100 for kid fun money a week. We didn’t always have $200 a week in unaccounted money but we do now. It works for us. You have to find your “cheat” amount.

This is how to live debt free you determine your cheat amount by figuring out your standard bills. Then you determine the amount you owe. You look at your income and determine the rate at which you will pay down your debt. The cheat amount I used to have was $25 for me and $25 for the kids. We were able to increase my cheat amount as our income rose and the debt we had was paid off. We have now paid off everything so my cheat amount is determined by how much we plan to save each month. We currently try to live on between $30,000 and $40,000 a year. The rest we place into accounts for emergencies, retirement, dental care like braces, a wedding fund, car fund, and a vacation fund. We are also saving for home improvements this year. We do not buy or do anything unless we have the cash to cover the expense.

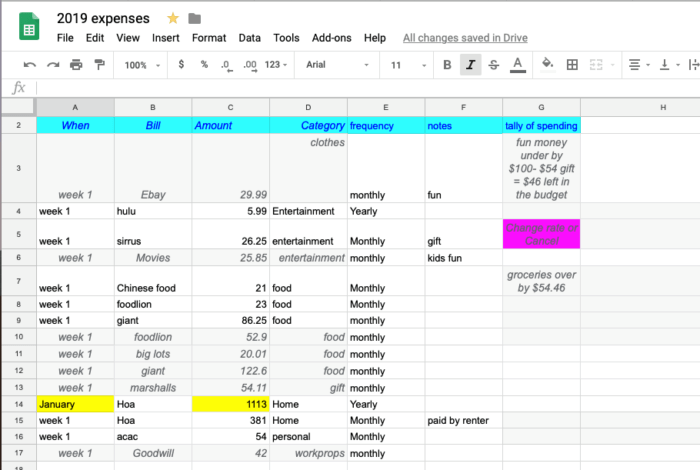

You can create a simple spreadsheet like I have using Google Docs. I just put in what I spend daily and then what type of expense it is. Then I look at it based on my monthly goals to determine what I have left to spend. I do this each Sunday night on Wednesday I pay off my credit card. That is right I do it each week! That allows we to build up cash back rewards but not go over my budget.

You can read some tips I have for living on $30,000

You can set up your budget here >>> How to live without debt

What is your cheat amount?

How to Get Out of Debt Problems

Cook, Baker, Phototaker, Fitness Mover and Shaker, Cupcake Tester, Deal Maker, Adventurous Undertaker, Do Good “Deeder”, Teacher, Mom, Wife, Patriot for Life & Giver of Good Advice – RealAdviceGal