Florida 529 Savings Plan

Disclosure: This is a sponsored post but all opinions expressed here are mine.

Florida 529 Savings Plan

The courage to aim for college after high school can start early. The confidence that children have growing up knowing that college is an option on the table is a privilege not most kids receive. Unfortunately, college tuition can be so impossibly high that many families simply cannot afford it on their own without accumulating massive amounts of debt. The reality is that children must receive a college education to achieve the bare minimum of their potential as adults. Just as easily as the courage and confidence can be given to them by knowing that those funds are waiting for them if they choose to use them, it can also be taken away if they are unsure how the cost of higher education will affect them, you, or your family in the immediate future.

I grew up as a kid who went through the first half of their primary years hearing about what a relief it was that my Florida Prepaid tuition plan was already taken care of and knowing that I had a path to college after high school. It wasn’t until high school that I realized that my family’s financial situation had forced my parents to stop paying into the fund and we had lost it. From then on out I pretended like college was not something I really wanted to do. It changed the entire trajectory of my life not knowing where the money to go to school would come from.

After high school I started working full-time while saving and planning what my future would look like. In a bold move I decided to apply to private colleges in New York City and swore that if I got in I would find the money somehow and make it work. As wonderful as that all sounds, the reality is that I accumulated a massive amount of personal debt and my parents also took on a student loan that they are still paying off even though I am in my late 30s. I swore that when I had kids I would make sure they always knew college was on the table and we would try our best to make sure that it stayed there. My parents tried, but sometimes life happens and that is why it is so important to plan.

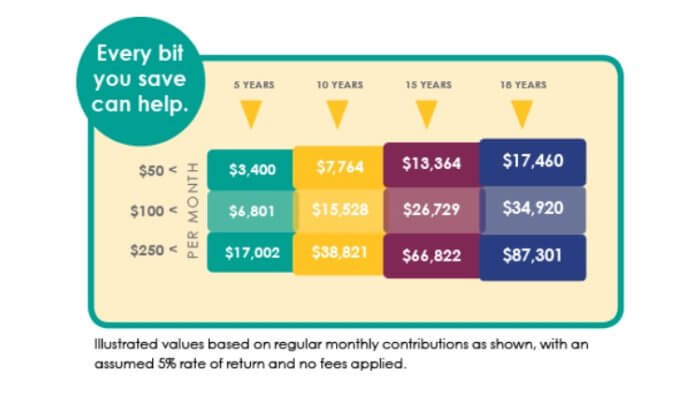

One option that we have chosen to supplement the Florida Prepaid plans for our children is The Florida 529 Savings Plan. It can be started at anytime and only requires a $25 initial deposit to open. Even if you can’t save for your child’s entire college education all at once, starting something is always better than doing nothing.

One major benefit for us in adding this to our plan is that funds in a Florida 529 Savings Plan can be used for any qualified higher educational expense, including tuition, room & board, textbooks, graduate school and much more. This gives you extreme flexibility to use the funds as you see fit, for whatever your child may need. And should those needs change during his/her college years, individuals are free to adjust as well.

The Florida 529 Savings Plan offers you the ultimate in flexibility. Simply choose from the investment options, then contribute as much and as often as you’d like to suit your budget and goals. Each investment option, such as our popular age-based option that automatically allocates contributions based on the age of the child, is independently run by professional investment managers. Go here for more information on how the investment managers. There are 11 investment options let you invest in any way you feel comfortable. From more aggressive to more conservative options, and with age-based and fully customized approaches, you have as much control as you want over how much you invest and where it’s invested. Go here for more information on those options. And as the years go by, you’re free to change contribution amounts and how they are allocated at any time.

In celebration of 529 Day (which was on May 25th), Florida Prepaid is giving 10 Florida families $529 in a Florida 529 Savings Plan!

Here are the details of the Florida 529 Savings Plan Scholarship Giveaway:

What: The Florida 529 Savings Plan Scholarship Program and you could be one of 10 lucky winners of a $529 scholarship deposited into a Florida 529 Savings Plan account.

When: Enter anytime between May 15 and June 11

How: Visit florida529savingsplanscholarship.com daily (You must be a Florida resident, 18 or over.)

Families can enter to win a Florida 529 Savings Plan Scholarship between May 15 and June 11, 2017, at www.Florida529SavingsPlanScholarship.com

What is a 529 Savings Plan?

529 savings plans are named after section 529 of the Internal Revenue Code 26 U.S.C. § 529 and are designed to encourage saving for future higher education expenses of a designated beneficiary. Many states offer 529 savings plan options, including Florida Prepaid.

Money from a 529 plan can be used for tuition, fees, books, supplies and equipment required for study at any accredited college, university or vocational school in the United States and at some foreign universities. The money can also be used for room and board, as long as the fund beneficiary is at least a half-time student. Off-campus housing costs are covered up to the allowance for room and board that the college includes in its cost of attendance for federal financial-aid purposes. Qualified education expenses do not include student loans and student loan interest. There is legislation currently going through Congress that will expand the qualified expenses.

See the website and FAQ for more details.

Learn more about Florida 529 Savings Plans at www.myfloridaprepaid.com.

Cook, Baker, Phototaker, Fitness Mover and Shaker, Cupcake Tester, Deal Maker, Adventurous Undertaker, Do Good “Deeder”, Teacher, Mom, Wife, Patriot for Life & Giver of Good Advice – RealAdviceGal