Money Savings Challenge: 52 Week Savings Plan

This year, one of my goal is to challenge myself to save money and be frugal. I know that if I do this in the long run it will benefit me and my family. One of the Savings Challenge that I want to do is the 52 Week Savings Plan.

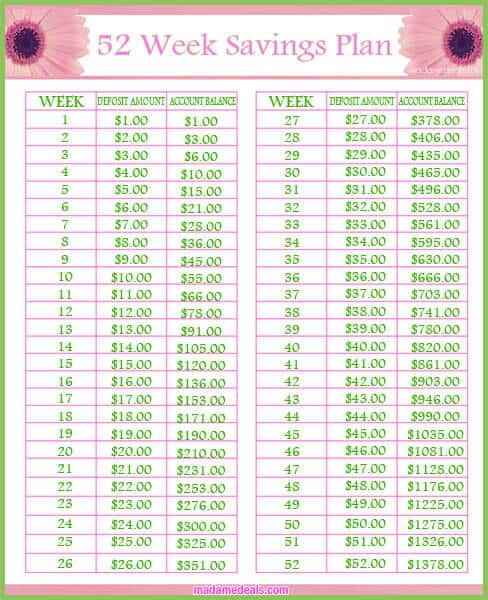

I saw this first from one of my friend and I immediately got interested. If you will look at the chart below, you can see that it’s something realistic. Unlike other money savings plan with this Savings Challenge you only have to save little amount each week and after 52 weeks you’ll have $1378!

The concept of 52 Week Savings Plan is very simple, you just have to save and deposit the amount that corresponds to the number of the week into your account. What I love about this plan is it’s not intimidating and even kids especially teens can do this. By saving small amounts, at the end of the challenge, you’ll have extra money.

52 Week Money Savings Plan

Ready to do our Savings Challenge? Click on the photo above to get our Printable 52 Week Savings Plan!

I encourage you to join us in doing this 52 Week Savings Plan. This is the perfect opportunity to start the year right and set a goal. You can also encourage kids to join you in the challenge, so that they will learn how to save money early. You can also do this 52 week savings plan in reverse. Everyone loves a good challenge right? Especially if this challenge will let you have $1378 after 52 weeks, so start saving now!

Build up your money saving skills with these books

Cook, Baker, Phototaker, Fitness Mover and Shaker, Cupcake Tester, Deal Maker, Adventurous Undertaker, Do Good “Deeder”, Teacher, Mom, Wife, Patriot for Life & Giver of Good Advice – RealAdviceGal