Healthy Living While Living Under $30,000

Healthy Living While Living Under $30,000

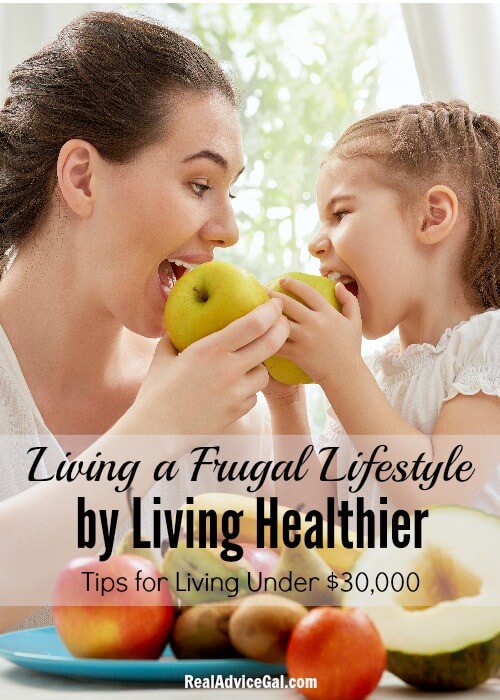

Living a frugal lifestyle by living healthier?

Is it possible that living frugally and being healthier go hand in hand? They sure do! Being frugal doesn’t mean living on less. It means making smarter decisions with what you have, including healthy living. Here are three big ways to live a healthier lifestyle while keeping your budget in shape:

Healthy Living While Living Under $30,000

Drop the gym! The weight of your bill from gym membership will probably outweigh the weight it can take off of your body. There are so many free ways to work out. Play tag with your kids for half an hour at the park. Talk about some cardio! Do 30 day challenges. Check out Pinterest for great ideas on how to get started on some awesome workouts. What about YouTube? There are plenty of free workout classes on YouTube available to you anytime, day or night. What’s even better is you don’t have to change out of your yoga pants or brush your teeth to go to the gym right there in your living room! Get creative, it will keep working out interesting.

Switch to water. This sounds simple, but cutting juice and soda out of your life will do you and your wallet a ton of good. Not only will you see incredible health benefits by cutting out unnecessary sugars from your diet, you will see incredible benefits to your bank account too. Why not try cold brewing iced coffee or tea at home? What about making your own juices or sodas with recipes like this sparkling watermelon lemonade? There are plenty of other things to drink that will taste just as good and cost so much less that your body will thank you for.

Girl/Guys Night Out? Happy hour can be not-so-happy on your budget. For most people the idea of a perfect guys night out or girls night out is at a bar with good food, good drinks, good music, and good friends. How about rethinking that idea? Have you considered a night out at a tea house with your girlfriends or playing basketball with the guys instead of hitting up a bar? This is an all around better quality way to nurture your friendships, your finances, and your health.

Frugal living is about more than the cheapest alternative to any situation. It is about living smarter so you don’t work harder. Rethink the way you look at health as a priority in your life and you will reap the benefits in more ways than one.

Read part 1 of Angie’s Living on $30,000 Best Frugal Tips on Thriving and (not just surviving) on $30,000 a year!

Part 2 – Basic Home Budgeting

Part 3 – How to Budget Monthly Finances Wisely

Part 4 – How to Not Spend Money

Part 5 – Smart Money Saving Tips to Control Your Debt

Part 6 – Money Management Skill

Part 7 – Why Couples Should Talk About Money?

How to Use Your Tax Refund to Build Wealth

How to Manage Food Budget for Family?

5 Ways to Save Money on Car Insurance

Find out How to Save Money for a Car

Angie Rumpf

I am a stay at home mom and happily married to my husband Tom. I have a five year old daughter and a two and a half year old son. I grew up in Orlando, but went to school in New York City and lived in Los Angeles before moving home to raise a family. I have worked in the film industry since the early nineties, and for over a decade with the Florida Film Festival. I also spent many years working in marketing with Glaceau and Honest Tea. But, I am happiest at home building my family.

For more Best Frugal Tips, read these:

How to get rich in 5 minutes a day

Frugal Ways to Save Money: Getting Out of Debts

How to Save Up Money: Tips for Living on $30000 or Less

Living on 30000 or Less: Raising a Family of 6

Living on 30000 or Less: Raising a Large Family

Cook, Baker, Phototaker, Fitness Mover and Shaker, Cupcake Tester, Deal Maker, Adventurous Undertaker, Do Good “Deeder”, Teacher, Mom, Wife, Patriot for Life & Giver of Good Advice – RealAdviceGal